Lender Options

Ready to build your dream home?

In today’s market, understanding the process is the first part of making your waterfront dreams a reality. The second part of that process is working with the best team in the industry. Let’s connect you to our local lenders who can help.

What types of loans should buyers be looking into?

- Lot Loan

- One-time-close: Construction loan converts to a mortgage

- Waterfront Home Line of Credit

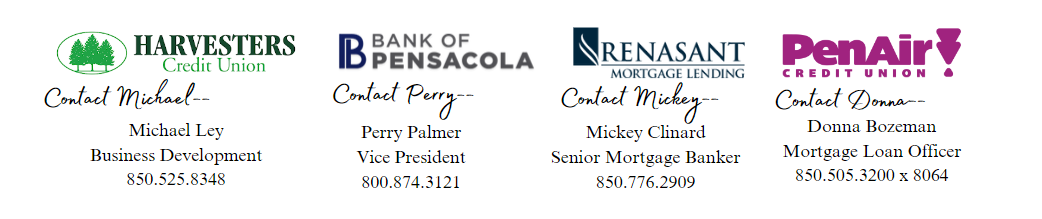

Lenders who are prepared to help navigate this journey:

- Harvesters Federal Credit Union

- Bank of Pensacola

- Renasant Mortgage and Lending

- PenAir Federal Credit Union

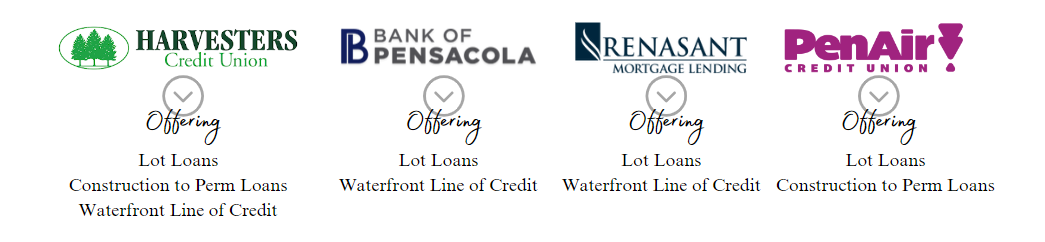

Three Product Options

- Lot Loans

- Construction to Permanent Loans

- Waterfront Line of Credit

Lot Loan Applications

- The borrower application is taken over the phone on online.

- Once the borrower provides supporting documents for the application then a pre-qualification can be provided within days.

- No out-of-pocket expenses to apply.

- The entire loan process takes approximately 30-45 days.

Lending Options for Simple Navigation

We are all too aware that trying to get all the details, numbers, contracts, and percentages just right is a huge task. Do not worry; you are not in this alone! We have close contacts at each of these establishments who can help direct you in the best path for your end goal. Each of these lending options has a myriad of tool to help with timing, interest rates, pay off schedules, and loan limits. Reach out today, and have these connections make owning at Redfish Harbor an easy reality.